New Year, New Relationships—Same Cup of Coffee? | 25, Issue 19

CHERYL HUNG, lead researcher for the NCA's National Coffee Data Trends studies, traces the impact of the pandemic on coffee consumption in the US and Canada, highlights the collective urge to reconnect, and calls for the coffee community to focus on marketing the emotional benefits and the “softer” aspects of America’s favorite morning beverage.

When I worked as a barista (twenty years ago), I enjoyed asking myself speculative questions about patterns in the drink orders I might receive at the small coffee shop where I worked. Would the ratio of filter coffee to milk-based espresso beverages change between weekdays and weekends? Yes, as it turned out: a higher proportion of weekday orders were filter coffee (to go). Would orders for frozen blended drinks slow down in the winter? Yes, though not as much as I expected. Would anyone ever order straight espresso, and if so, who? Yes, on one memorable occasion, a group of Italians visiting the area on business came in and ordered a round of espressos that they were nice— or jet-lagged—enough to drink without grimacing when I passed their espresso shots across the counter in paper cups.

Looking back, it’s easy for me to see how these order patterns fit into larger trends of that era and place, but at the time, these observations were just that: observations. They had some value to owners of the shop where I worked, but I would not have been able to say that they were representative of coffee consumption patterns in the city where I lived, or even consistent with the order patterns at the other coffee shop on the same block, because I didn’t have access to good data. Collecting data on a scale that yields meaningful insights is resource-intensive work, which is why coffee shops (and other small businesses) so often rely on their experiences and intuition to make decisions. It’s also time-sensitive work—at least, it is when the data relate to consumer preferences— because trends change.

Correctly forecasting trends is never easy, but the uncertainty of the past few years has made the value of credible data clearer than ever. In her article, Cheryl Hung uses data from the NCA's National Coffee Data Trends (NCDT) Study,[1] the longest-running survey on coffee consumption in the US (and now Canada, too!) to help the coffee industry understand what has changed— and what hasn’t—since the onset of COVID-19 in early 2020. At that time, popular press articles posed wildly speculative questions about the impact the pandemic might have on coffee consumption patterns, and Hung’s research with DIG Insights offers answers. Was this to be the end of the independent coffee shop? No, it wasn’t, because these shops demonstrated that they offered more than just a caffeinated beverage to their customers and communities. Would coffee businesses need to rethink their marketing strategies to appeal to risk-averse consumers? Yes, but no single strategy could work for all of them, and the innovations of the past three years reflect the diversity of business models in the coffee industry.

The findings of the NCDT will undoubtedly line up with the experiences of some readers—you might even belong to one of the innovative shops! For others, this will be the first time that consumption trends are made available with data to back them up. These data are important because they allow us to separate market speculation from market realities, and that, in turn, reduces the risk associated with making business decisions. This is critical for coffee businesses around the world and across the value chain, from producers seeking a clearer picture of how their products will be received to baristas curious to know how their customers’ drink orders fit into macro-level trends.

Kim Elena Ionescu

Chief Sustainability and Knowledge Development Officer

As the world enters its third year living with COVID-19, it turns out even a global pandemic can’t disrupt some universal truths about coffee consumption.

COVID-19 certainly didn’t stop Americans from drinking coffee: in 2020, at the very start of the pandemic when things were still uncertain, 62% of Americans had at least one cup of coffee within the previous 24-hour period, which is comparable to pre-pandemic levels. As the lead researcher working on the National Coffee Data Trends report for the National Coffee Association (NCA) and the Coffee Association of Canada (CAC), we’ve continued to observe this trend, with similar (if not stronger) consumption levels in the same period (“past day”) in 2021 and 2022. It also didn’t stop American consumers from drinking espresso- based coffee beverages: the consumption of drinks like lattes and cappuccinos remained fairly consistent, despite these beverages (at least historically) being more likely to be prepared “out of the home.”

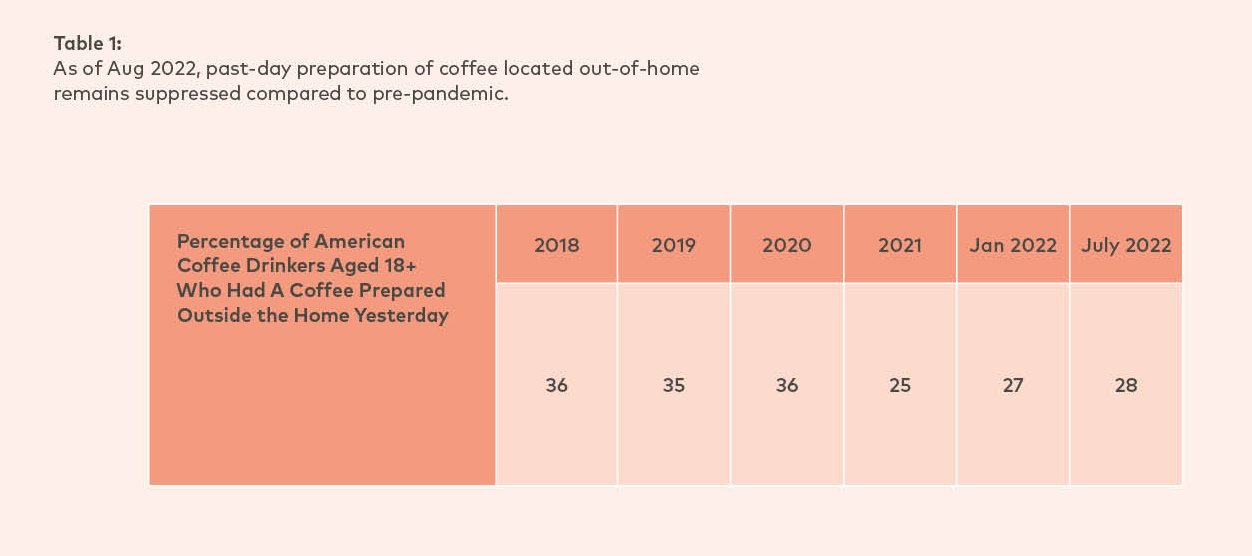

Table 1: As of Aug 2022, past-day preparation of coffee located out-of-home remains suppressed compared to pre-pandemic.

It turns out that, although there were varying public health restrictions and lockdown rules in place across the US and Canada throughout 2020–2022, American consumers still found ways to access specialty drinks. And when it wasn’t possible to venture out to get coffee, American consumers still found ways to try new things at home—new beverage trends like Dalgona coffee, a creamy whipped instant coffee, proliferated after popping up on TikTok. American consumers’ craving for innovation isn’t likely to taper off as the world continues to emerge from the pandemic; it will likely accelerate as consumers look to reconnect and seek new experiences.

This apparent consistency in consumer behavior gave many marketers and business owners alike reassurance in the face of uncertainty. The coffee community adapted and persisted, a key theme of the industry’s resilience and recovery efforts. So, what has changed?

As you may have guessed, although coffee consumption stayed fairly consistent, the greatest impact is where coffee is consumed. As of August 2022, past-day preparation of coffee located outside the home remains suppressed compared to pre-pandemic.[1] At this point, many American coffee consumers have established new routines. As hybrid or remote work continues, this will likely include making coffee at home. Of course, not all have adopted (and stuck with) their pandemic schedules, but it is likely that out-of-home coffee preparation volumes may continue to be suppressed in the foreseeable future.

Figure 1: COVID-19 didn’t stop consumers from trying new things.

Consumers have also changed: the world has been through a lot. Alongside the pandemic, consumers have experienced a racial reckoning and call-for-action to support marginalized communities, employers grappling with the call “back to work” (and “quiet quitting” in response), unprecedented extreme weather events, supply chain issues, high inflation, the war in Ukraine—the list goes on.

We’ve also collectively experienced loneliness (ironically!), as our desire to reconnect with our loved ones shows. For example, the ease with which a well-known gum brand’s commercial, depicting “life after COVID,”[2] went viral at a time when gum and mint sales were showing a significant decline in comparison to pre-pandemic levels suggested just how thirsty we were for social interaction after two-and-a-half years of isolation. How can the coffee community tap into this insight and be a conduit to help consumers reconnect?

The Perfect Beans to an End

Coffee is America’s beloved beverage: more Americans (and Canadians[3]) drank a cup of coffee than they did tap water yesterday.

American consumers know coffee best for its functional, caffeinated properties, but they appreciate it for its taste, too: the specialty industry has done a great job communicating coffee’s varied flavor attributes and brewing methods. “This dark roast has notes of cherry and cacao; this light roast, hints of floral and fresh citrus—both now available as whole beans, ground, or single-cup machine compatible!” It’s much harder to capture the experience of connecting over coffee in a few words on a package, so maybe the industry’s next marketing challenge is to find a way of showing coffee’s emotional value.

The emotional side of coffee marketing more often comes through in advertisements. Think of some of the coffee ads you’ve come across in recent years. An image of a young woman smelling her first cup of the day as she unpacks in her new home (“coffee supports you through life’s moments”[4]), or perhaps it was one of your favorite celebrities promoting the brand (“If George Clooney or Justin Bieber like it, this coffee is for you too.”[5]) But this approach only scratches the surface of coffee’s emotional marketing potential: how many times have you felt energized after catching up with a friend over coffee (and not just because you ordered a triple espresso)?

Coffee brings us together: it’s an excuse to meet, but it’s also often the place consumers share the happiest and saddest news with loved ones. Throughout my career working with private clients looking to understand the drivers behind coffee consumption, the less obvious opportunities for a brand’s growth lie within softer attributes like emotional needs. The average American or Canadian coffee drinker consumes just over 2.5 cups in a day,[6] and each one of these cups could act as a backdrop to life’s connections and conversations—that’s a lot of opportunity for the coffee industry to help establish meaningful connection with one another (and a lot of coffee cups)! At the time of writing, the very first flight between Canada and Hong Kong since early 2020 has landed, bringing together many who have been kept apart due to China’s zero COVID-19 policy for the past three years. You can bet that food and beverages— including coffee—will be a part of reuniting families and friends in 2023.

The Opportunities to Continue Marketing Coffee’s Functionality

This is not to say that coffee should only be marketed emotionally: there are plenty of opportunities for coffee to continue to highlight its functional benefits (i.e., coffee’s health benefits or the fact that moderate caffeine consumption isn’t inherently bad). But as consumers’ sense of “health and well-being” shifts and expands—not all consumers value coffee’s caffeine content—it may also be valuable to expand elevated decaf options too.

Other categories with a similar overlap of “functional,” taste, social, and health attributes—like beer and wine— have already spent years innovating their marketing approach as they seek to appeal to wider audiences and/ or provide different types of consumption experiences to their consumers. Product innovations in non-alcoholic and low-calorie categories are top-of-mind, but consider the experiential factor: the availability of these options opens up new usage occasions and may appeal to a new consumer. By moving beyond flavor attributes—appealing only to “a connoisseur” palate—both beer and wine have embraced a more casual approach to pairings, increasing the number of environments in which you might find beverages embraced for their distinctive flavor attributes with one audience but relished for their social role with another. One of my favorite examples of this are wine brands detailing wine-and-potato- chip flavor pairings![7] The key is that our consumption experience, regardless of the product being consumed, is generally elevated when there is a shared emotional connection. As we come out of the pandemic, given that there’s already a clear desire for more comfort and shared experience, coffee is already poised to help bring us back together.

Supporting the Community Your Way

The connections between coffee and community already exist, and various coffee brands have already deepened their connection with local communities over the past three years by aligning with social causes they’re most passionate about. These include Black, Indigenous, and People of Color (BIPOC) communities, women, children, and other marginalized groups. For example, Native-American owned brand Spirit Mountain Roasting Co. (based in California) gives a portion of its profits back to the Indigenous community through local non-profit organizations.[8] Cxffeeblack’s brand identity and storytelling educate the consumer on coffee’s Ethiopian roots while empowering Black coffee drinkers to reclaim their history with coffee.[9]

What support looks like for each brand is varied, just like the coffee bean itself. To be fair, corporate and social responsibility (CSR) initiatives are not new. In the coffee industry, “fair trade” approaches and sustainability efforts have been around for decades! But supporting local communities and having visibility among its consumers have become more prevalent in recent years, largely thanks to social media.

In both the US and Canada, older consumers are more likely to be coffee consumers than are younger people. Another opportunity to support community comes in the form of holding space for those most likely to be isolated, like older consumers. Addressing loneliness and isolation will be critical to combatting mental health in the years to come, and coffee brands may be in a unique position to make an impact at the individual level. Coffee shops are certainly ubiquitous in most urban centers and even those in less densely populated areas are in a great position to forge old and new relationships. In the marketing world, brands will tout that they “stay close” to their consumers to address their wants and needs. As consumers, we need help—help in finding meaningful connection with each other and space to do so, and we want our favorite coffee brands to lead the way.

In a small Canadian town, a bench popped up, just outside a community arts center. The bench looks like any ordinary bench you’d find at a bus stop, only it has a small sign that reads “Happy to Chat.”[10] It was recently installed to invite people to connect with others in a bid to help residents combat loneliness and provide a public space to reconnect. What if every coffee shop sponsored a bench or had a “Happy to Chat” table inside their café? “Bonus one free refill if you chat with two different strangers, or discounted rate for your next beverage if you #happytochatovercoffee and tag us on our IG page” (a way to include the younger demographic). The marketing potential!

Relieving social isolation felt by the pandemic is only one cause a coffee brand can address–the point is that the coffee community is well aligned to speak to emotional benefits while still touting the functional aspects of the product. As more consumers choose to prioritize their personal well-being and relationships over these next few years, coffee can be the beverage of choice to aid in these opportunities and help consumers build relationships, old and new. ◇

CHERYL HUNG is a market research and insights consultant at DIG Insights. She leads the National Coffee Association and Coffee Association of Canada’s coffee tracking work and is a volunteer for the Coffee Coalition for Racial Equity, previously serving as a Board Member from 2020 to 2022. Cheryl has also contributed to Coffee People Zine and Go Fund Bean and prefers to take her coffee black with a little honey.

The author would like to thank the National Coffee Association (NCA) and the Coffee Association of Canada (CAC) for permission to use the National Coffee Data Trends data cited in this article.

References

[1] https://www.ncausa.org/Research-Trends/Market-Research/NCDT

[1] See Table 1. National Coffee Association (NCA), “Past Day Out-of-Home Preparation,” The National Coffee Data Trends Study, Fall Report (August 2022).

[2] Wrigley-Mars Inc. “For When It’s Time” EXTRA gum (May 2021), https://www.youtube.com/watch?v=jyl8eKa6faA.

[3] National Coffee Association (NCA), “Past Day Beverage Penetration,” The National Coffee Data Trends Study, Fall Report (August 2022); Coffee Association of Canada (CAC), “Past Day Beverage Penetration,” Wave 2 Report (October 2022).

[4] Folgers Classic Roast Coffee “Moving In” (July 2016), https://www.youtube.com/watch?v=P9ihN5041bE.

[5] Nestle-Nespresso “Unforgettable Taste” campaign (November 2022), https://www.youtube.com/watch?v=1NDs2DpSuGI; Tim Horton’s “Timbiebs” Justin Bieber Collaboration (November 2021), https://www.youtube.com/watch?v=WdPRc8u_OLY.

[6] National Coffee Association (NCA), “Number of Cups Per Day – Per Total Coffee by Past Day Coffee Drinkers,” The National Coffee Data Trends Study, Fall Report (August 2022); Coffee Association of Canada (CAC), “Past Day Beverage Penetration,” Wave 2 Report (October 2022).

[7] Megan Haynes, “Vino’s Strange Bedfellows,” Strategy Magazine (December 2012), https://strategyonline.ca/2012/12/04/vinos-strange-bedfellows/.

[8] Spirit Mountain Roasting Co. (January 2022), https://www.spiritmountainroasting.com/.

[9] Cxffeeblack (January 2022), https://cxffeeblack.com/en-ca.

[10] Sheila Wang, “Compassion York Region introduces Happy To Chat Bench,” Richmond Hill Liberal (January 4, 2023), https://www.yorkregion.com/community-story/10815882--it-s-like-an-invitation-compassion-york-region-introduces-happy-to-chat-bench-in-richmond-hill/.

We hope you are as excited as we are about the release of 25, Issue 19. This issue of 25 is made possible with the contributions of specialty coffee businesses who support the activities of the Specialty Coffee Association through its underwriting and sponsorship programs. Learn more about our underwriters here.